Facts About Property By Helander Llc Uncovered

Table of ContentsAn Unbiased View of Property By Helander Llc8 Simple Techniques For Property By Helander LlcThe Of Property By Helander LlcMore About Property By Helander LlcThe Of Property By Helander LlcSome Known Details About Property By Helander Llc

The benefits of investing in genuine estate are countless. Here's what you need to know about real estate advantages and why actual estate is thought about an excellent financial investment.The advantages of spending in realty include passive earnings, steady cash money flow, tax benefits, diversity, and take advantage of. Real estate investment company (REITs) provide a method to spend in property without having to own, operate, or financing residential or commercial properties - (https://www.callupcontact.com/b/businessprofile/Property_By_Helander_LLC/9333586). Cash money circulation is the net income from a realty financial investment after home loan repayments and operating budget have been made.

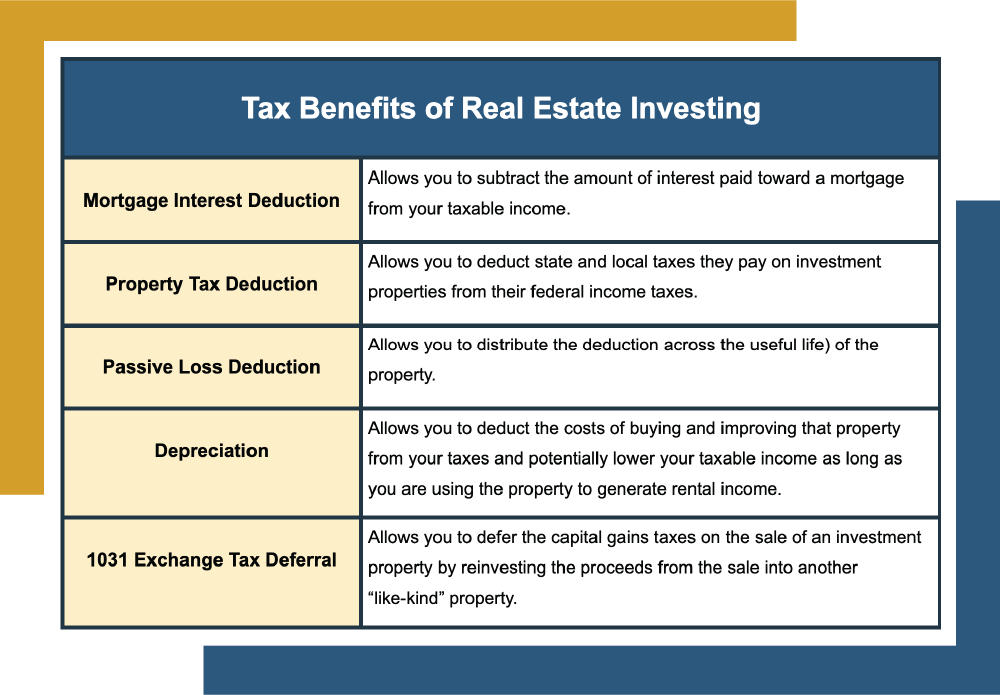

In several cases, capital only strengthens over time as you pay down your mortgageand develop your equity. Investor can make the most of many tax obligation breaks and reductions that can save cash at tax time. As a whole, you can deduct the reasonable costs of owning, operating, and taking care of a residential property.

Everything about Property By Helander Llc

Genuine estate values have a tendency to raise over time, and with a good investment, you can turn a profit when it's time to market. As you pay down a residential property home mortgage, you build equityan possession that's component of your internet well worth. And as you develop equity, you have the utilize to get even more residential properties and increase cash circulation and riches also extra.

Since actual estate is a tangible possession and one that can function as security, funding is readily available. Realty returns vary, depending on factors such as place, possession class, and management. Still, a number that numerous financiers intend for is to beat the average returns of the S&P 500what many individuals refer to when they claim, "the marketplace." The rising cost of living hedging capacity of property originates from the favorable connection in between GDP growth and the need genuine estate.

Property By Helander Llc for Beginners

This, in turn, equates right into greater funding values. Genuine estate has a tendency to maintain the acquiring power of capital by passing some of the inflationary stress on to tenants and by incorporating some of the inflationary stress in the form of capital admiration - realtors in sandpoint idaho.

Indirect property spending involves no straight ownership of a residential property or residential properties. Rather, you purchase a swimming pool together with look at here now others, whereby an administration firm possesses and runs residential properties, otherwise has a portfolio of mortgages. There are numerous means that having realty can protect versus rising cost of living. First, property worths may rise more than the price of rising cost of living, bring about funding gains.

Lastly, homes funded with a fixed-rate car loan will see the loved one amount of the monthly home loan payments tip over time-- for circumstances $1,000 a month as a fixed settlement will become less difficult as inflation wears down the purchasing power of that $1,000. Typically, a key house is not taken into consideration to be a realty financial investment since it is made use of as one's home

7 Easy Facts About Property By Helander Llc Described

Despite the help of a broker, it can take a couple of weeks of job simply to locate the ideal counterparty. Still, real estate is a distinct property class that's simple to comprehend and can enhance the risk-and-return profile of an investor's portfolio. On its own, realty provides capital, tax breaks, equity structure, competitive risk-adjusted returns, and a bush against inflation.

Buying property can be an extremely rewarding and lucrative venture, but if you're like a great deal of brand-new financiers, you might be wondering WHY you must be buying property and what advantages it brings over other financial investment opportunities. In enhancement to all the impressive benefits that come along with spending in genuine estate, there are some drawbacks you require to think about.

Things about Property By Helander Llc

If you're searching for a way to purchase right into the genuine estate market without having to invest hundreds of thousands of dollars, have a look at our buildings. At BuyProperly, we make use of a fractional ownership version that allows financiers to begin with just $2500. An additional significant advantage of realty investing is the capability to make a high return from purchasing, renovating, and reselling (a.k.a.

Fascination About Property By Helander Llc

For example, if you are charging $2,000 rent each month and you incurred $1,500 in tax-deductible costs each month, you will just be paying tax obligation on that $500 earnings per month. That's a big distinction from paying tax obligations on $2,000 each month. The profit that you make on your rental system for the year is considered rental income and will be taxed accordingly